What’s next for markets now that the

Federal Reserve

has delivered its fourth and possibly final jumbo rate increase of 75 basis points?

Well, a lot, actually.

A sometimes tumultuous third-quarter earnings season isn’t over yet. A packed economic-data calendar in the coming weeks includes key readings on inflation and the labor market. On top of that, the U.S. midterm elections could result in Democrats losing control of one, or both, chambers of Congress.

MarketWatch spoke with several market gurus about what investors should watch out for, and what it all might mean for their portfolios.

Inflation, jobs data could force the Fed to keep rates ‘higher for longer’

The Fed may be penciling in another rate increase of 50 basis points at its December meeting, but any sign that inflation isn’t trending toward the central bank’s target still could send stocks reeling and Treasury yields surging, market strategists said.

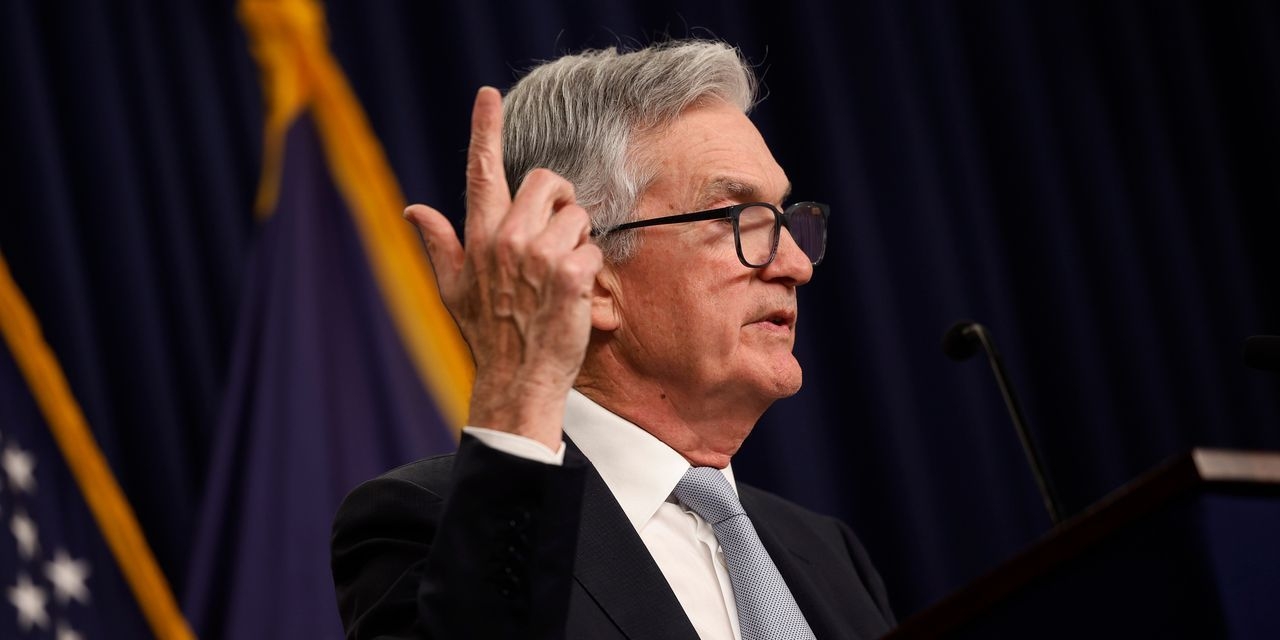

Although headline inflation has softened from the fastest pace in more than 40 years, core prices are still accelerating at an uncomfortable rate, and wage growth remains a “mixed bag,” as Chairman Jerome Powell said Wednesday.

“A lot of what the Fed ultimately does will depend on what happens with inflation,” said Jack Ablin, founding partner and chief investment officer at Cresset Capital.

The consumer-price index for October is due out on Nov. 10, followed by the personal-consumption expenditures index, the Fed’s preferred barometer of inflation pressures, on Dec. 1.

But there’s still plenty to learn about inflation from the October jobs report due out Friday, including its reading on average hourly earnings.

“I think certainly the payrolls number is important, and it all circles back to what it means for inflation,” Ablin said.

Bottom line: Any indication that the Fed will need to keep interest rates “higher for longer” to combat inflation could exacerbate the weakness in both stocks and bond prices, which move inversely to yields, seen so far this year.

And as Powell reiterated on Wednesday, with price pressures still so intense, any talk of a Fed pivot back toward interest-rate cuts remains very “premature.”

“The increased momentum of inflation sets a high bar for the Fed to end the current rate hike cycle and an even higher one to begin cutting rates,” said Bill Adams, chief economist for Comerica Bank.

Source : www.marketwatch.com/story/this-is-whats-next-for-markets-after-the-feds-4th-jumbo-rate-hike-11667424054?mod=newsviewer_click undefined - November 02, 2022