Savings

Grow your savings with Flex vault

Forget about traditional savings accounts offering low risk but low to no return. Tap into our innovative Flex vault and earn up to 6.5% APY (*) (**) (***) !

6.5%*

Up to (APY)

Gain Financial freedom

Earn daily interest

Withdraw in Euro or USDT 24/7

* Compound interest refers to interest applied not only on the initial principal but also on the accumulated interest

** Maximum interests obtained through the Ambassador program

*** Rates generated (see FAQ at bottom of page)

overview

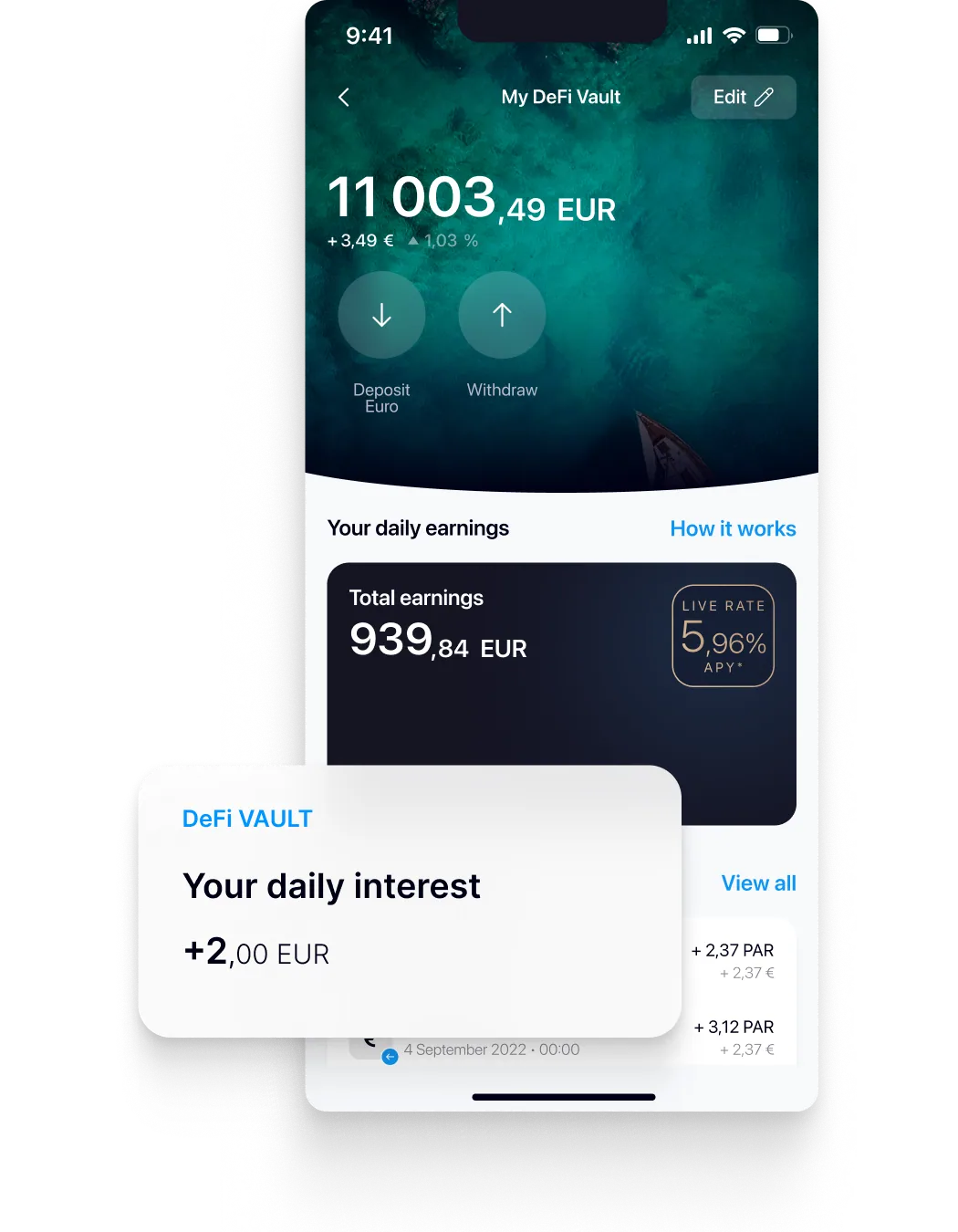

Daily interest & innovative savings plan

Powered by complex blockchain technology, our Flex vault is free and offers high daily interest. Withdraw your capital and interest anytime by choosing the asset you want: Euro or USDT.

Set-up

Free. Flexible. Powerful.

Our Flex Vault allows you to generate gains with compound annual rates up to 5% per year (up to 6.5% with our Ambassador program) thanks to an intelligent allocation composed by Blockchain technology allowing access to decentralized finance (Protocol Defi MIMO Capital) and to the exploitation of the Bitcoin blockchain (Cloud mining).

Allocation of the Flex Vault

- PAR Unstaked 30% ;

- PAR Staked (MIMO Capital) 50% ;

- PAR allocated in the RAYN cloud mining program.

REALIZE ALL YOUR PROJECTS

Realize an infinite number of projects by unleashing the power of savings through blockchain

Frequently asked questions

What are the differences between the Flex Vault and a traditional savings account?

Our Flex Vault allows you to generate gains with compound annual rates up to 5% per year (up to 6.5% with our Ambassadeur program) thanks to an intelligent allocation composed by Blockchain technology giving access to decentralized finance (Protocol Defi MIMO Capital) and the exploitation of the Bitcoin blockchain (Cloud mining).

Like traditional savings products restricted by the key interest rates of central banks, the Flex Vault is a revolutionary solution designed to generate higher returns, with gains compounded by decentralized finance.Flex Vault also offers greater flexibility: you can deposit and withdraw whenever you like, with no limits. Your returns are calculated and credited on a daily basis, so you can enjoy them 365 days a year.

How does it work?

- The PAR amount exchanged is then allocated into the three following compartments:

- 30% PAR non staké to ensure the liquidity of the Flex Vault

- 50% PAR Staké in the DEFI MIMO Capital* protocol

- 20% PAR allocated to the RAYN** Cloud Mining Program.

* MIMO Capital RAYN's DEFI protocol

RAYN enables users to interact directly with decentralized finance protocols (" DeFi ") to participate in yield farming activities.

To this end, RAYN has selected the protocol developed by Mimo Capital AG ("Mimo"), a Liechtenstein company headquartered at Alvierweg 17, 9490 Vaduz, Liechtenstein, registered in Liechtenstein under number FL-0002.584.786-1.

Mimo offers a DeFi protocol enabling crypto-assets, such as BTC or ETH, to be deposited on a Vault taking the form of a smart contract, in order to mine a EURO stablecoin entitled "PAR". On the Mimo protocol, each vault is unique, and the assets deposited there are blocked and covered by asafety reserve. Once the PAR token has been mined, it can be stored in Curve or Balancer liquidity pools, which generate returns. Mimo records a very high level of over-collateralization.

**RAYN Cloud Mining Program

RAYN through its subsidiaries has established partnerships with third-party entities (including Hearst, Bitmain) to offer bitcoin mining services (the " Cloud Mining Program ") to its users.

Bitcoin mining is a process that involves creating new bitcoins by using computers to solve mathematical problems through a process known as Proof of Work. This process requires significant computing power and electricity consumption.

The Mining Program allows the Flex Vault user to rent computing power(hashrate) from mining machines owned by RAYN subsidiaries and operated by RAYN Partners (" Cloud Mining "), in return for daily rewards earned in bitcoins and converted by the relevant provider into PAR (the " Mining Rewards ").

How safe is the Flex vault?

Ensuring the safety of your funds is paramount to us, which is why we've partnered with Mimo Capital AG, a European entity registered with the Financial Market Authority of Liechtenstein (FMA) as a technological service provider. This collaboration enables us to introduce an innovative product to the Blockchain ecosystem: the Flex Vault.

How many vaults can I create?

You can create an unlimited number of vaults!

What is APY?

Compound interest is calculated on both the initial capital amount and the accumulated returns on that same capital. In other words, compound interest is not only applied to the initial capital but also on the interest already credited.

How often do I receive my gains?

Your gains are credited every day!

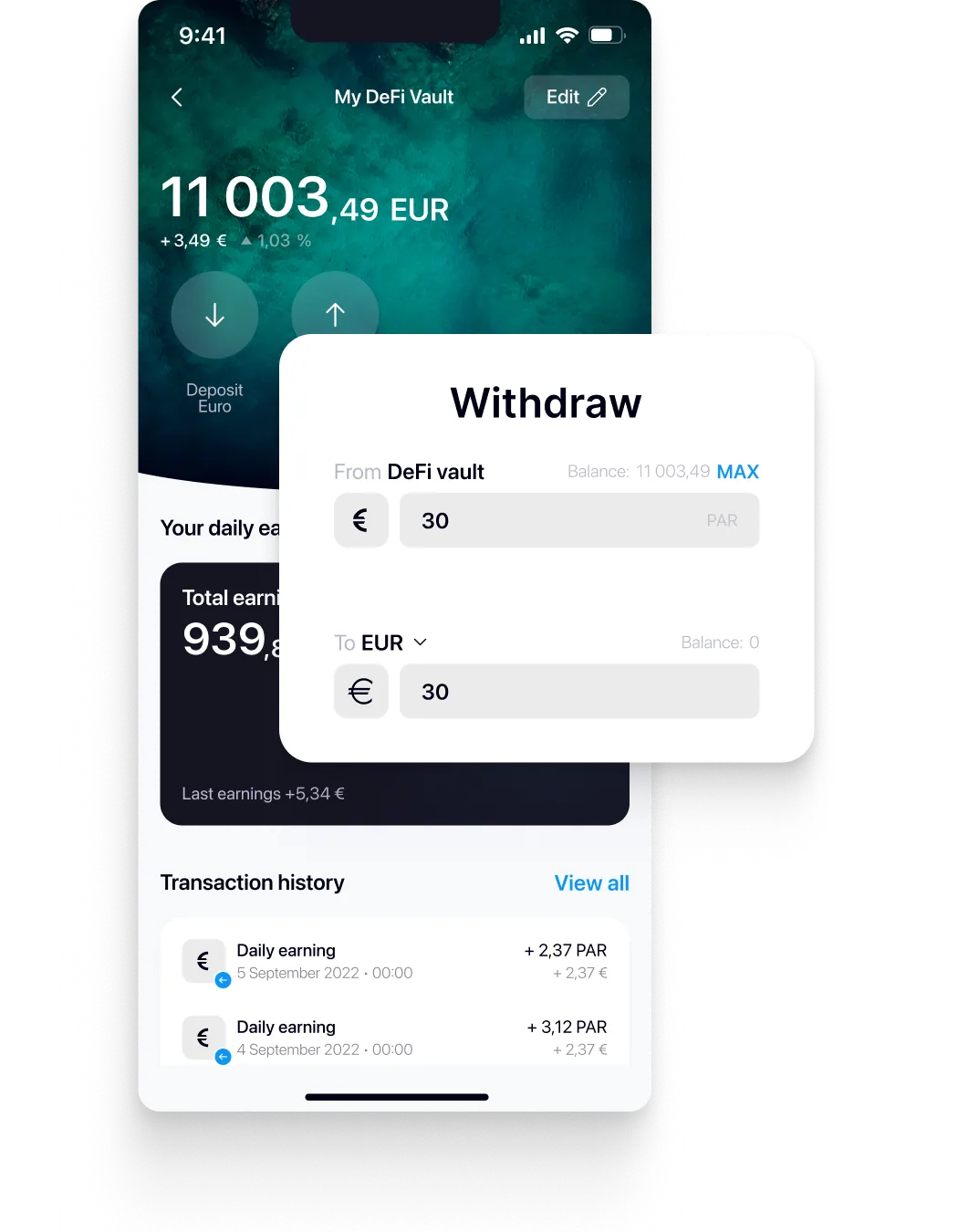

Can I withdraw at any time?

Enjoy the flexibility to withdraw your funds at any time! Two options are available:

Please note that transaction fees will be applied if you choose to withdraw in USDT, depending on your subscription (more details on this page).

The platform for managing your account, savings, and investments.