Invest

The portfolio you need in one-click

Demystify investing with Rayn: Smart investing has never been easier. Our automated and diversified portfolio gives you access to a balanced and high-performing investment strategy, traditionally reserved for finance experts.

No need to monitor your investments day and night, Rayn's Diversified Portfolio takes care of everything! (*) (**)

Volatility management system

High-performing algorithms

Active monitoring by our experts

Diversified Crypto Portfolio

* Past performance is not a reliable indicator of future performance - Investing in the crypto portfolio carries risks: https://rayn.finance/risk-warning/

** Portfolio performance does not take into account the user's risk profile (active capital protection option)

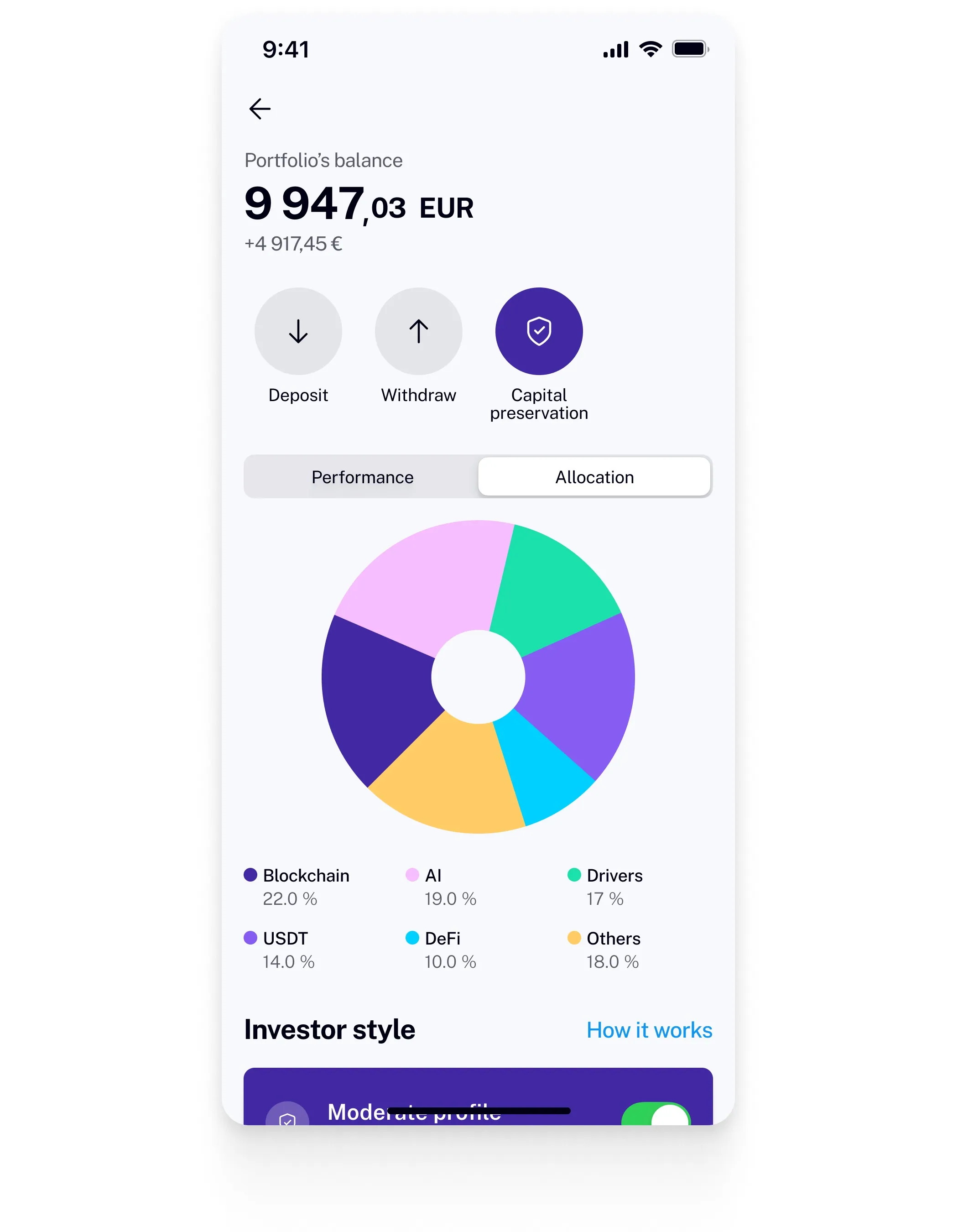

Diversified and Automated

Entrust your investment to our expert traders!

With just one click, your funds are automatically distributed among several cryptocurrencies, optimizing returns and reducing your portfolio's volatility through our advanced algorithms.

The portfolio is only exposed to buying on the spot market. (Long only - Spot market)

MANAGING YOUR RISK

Priority to preserving your capital

Our capital preservation algorithm can be activated or deactivated at your request, thus minimizing exposure to investment volatility based on the user's risk profile.

By quickly answering a simple questionnaire, we determine your risk profile to adjust your portfolio's volatility. In the event of a sharp market downturn, our system will automatically reallocate your funds to a lower-risk pool (USDT), thereby limiting your exposure to risks.

Change your investment style at any time while retaining control over the level of risk you wish to take.

Details

Expert allocation review

Auto

Rebalancing

Auto

Trading fees

0.5 %

Target / Current allocation

Live

Frequently asked questions

What is the Diversified Portfolio?

The Diversified Portfolio is a convenient solution for investors looking to enter the world of cryptocurrencies. In just a few clicks, your capital is distributed across different cryptocurrencies, reducing risk exposure and aligning with the strategy developed by our in-house experts.

Rayn's Diversified Portfolio aims to significantly reduce volatility and negative performance during cryptocurrency market downturns while maximizing gains during upswings.

Investing in the Diversified Portfolio carries risks: https://rayn.finance/risk-warning/

What is the Portfolio performance and when can I expect gains?

The Diversified Portfolio is designed to optimize performance during an upward cycle and reduce the impact of volatility and negative performance during downward cycles.

The Portfolio is only exposed to Spot markets available through our application.

The Portfolio does not hold any positions in derivative products.

Our Portfolio is designed for users looking to invest in cryptocurrencies over a minimum period of several months. Given the unpredictability of alternating up and down cycles, positive Portfolio performance is more likely in the medium to long term.

Investing in the Diversified Portfolio carries risks: https://rayn.finance/risk-warning/

How is the Diversified Portfolio balanced?

Through various themes, our experts' selection is automatically adjusted by our algorithms following market fluctuations, without the need for your intervention.

The Portfolio is capable of analyzing market movements via sophisticated algorithms to optimize your returns while reducing the risk of capital loss.

What is the minimum investment amount?

Currently, the minimum amount is €100 to allow as many people as possible to benefit from a well-balanced Portfolio.

Deposit/Withdrawal - How does it work?

You can deposit and withdraw funds from the Diversified Portfolio at any time, noting that the minimum deposit required is €100 or 100 USDT.

Can I modify my investment profile?

You can modify your investment profile at any time. Choose from our 5 profiles to benefit from a Customized Diversified Portfolio tailored to your needs.

Choose between:

- Prudent

- Moderately Prudent

- Moderate

- Moderately Aggressive

- Aggressive

The platform for managing your account, savings, and investments.