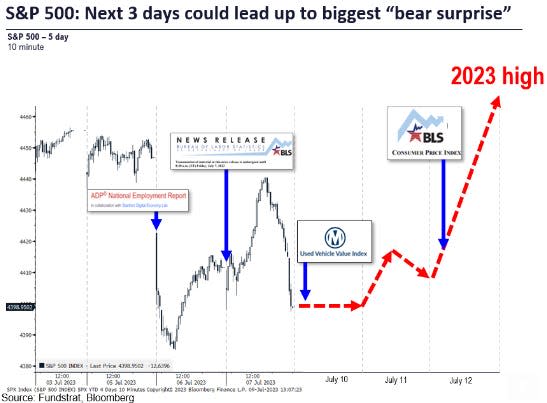

Cindy Ord/Getty ImagesThe S&P 500 is poised for a 2% rally this week that should push the index past 4,500, according to Fundstrat.The firm said it expects the June CPI report to show that inflation is continuing to decelerate."For the first time this year, we are issuing a short-term tactical buy call on the S&P 500," Fundstrat's Tom Lee said.Fundstrat issued a tactical buy recommendation on the S&P 500 for this week, expecting that the index will surge more than 2% to above the 4,500 level, according to a Monday note.The main catalyst for the expected jump higher is lower-than-expected inflation, with Fundstrat's Tom Lee estimating that the June CPI report, due out this Wednesday, could show a month-over-month print of 0.25%, which would be below consensus estimates of 0.30%.

Additionally, last week's sell-off in stocks sparked by a hot ADP jobs report that was followed up by a weaker-than-expected employment report from the Bureau of Labor Statistics provides an attractive entry point into the stock market."We do not typically issue such short term tactical calls, but given the softness of markets following the ADP and BLS jobs report, we think the timing makes sense," Lee said.Lee's confidence in a low inflation report is driven by the continued decline in used car prices, as well as seasonal adjustment factors that should push Core CPI lower in June and July. Lee also highlighted that 42% of CPI components are in outright deflation, which is well above the long-term average of the index.

A low inflation reading would be bullish for the stock market because it would undermine the view that the Federal Reserve will keep interest rates higher for longer. It would likely also put downside pressure on short-term rates and hurt the idea that the rally in stocks since the low last October is merely a bear market rally."We think investors have shifted towards a 'hawkish Fed' view, and a 'higher for longer' which is reflected in the rise in yields. So, the idea of a tactical re-think from a light CPI report would make sense," Lee said.The tactical buy recommendation from Fundstrat is in place until this Friday, July 14."If our view is correct, there will be a rapid re-assessment of views, which drives this upside," Lee said. "This would essentially shatter the bear market thesis."

Source : [Inflation is about to show a big drop and investors should load up on stocks ahead of this week's CPI report, Fundstrat says]

Yahoo Finance / July 11, 2023