Bitcoin struggles to reclaim $30k amid expectations of continued decline in inflation, according to recent reports. Continue reading at DailyCoin.

- Bitcoin has reached $27,500 as markets anticipate positive U.S. inflation data.

- BTC/USD has remained in a narrow trading range prior to the release of the April CPI.

- The CPI has been a key metric the Federal Reserve considers when adjusting interest rates.

On May 10th, Bitcoin reached a price point of $27,500 amidst anticipation of positive United States inflation data. BTC/USD remained within a narrow trading range in the lead-up to the release of the April Consumer Price Index (CPI), according to data from TradingView.

CPI Data Suggests Lower Inflation: Bulls Struggle to Recover

CPI is a significant metric used by the Federal Reserve to determine changes in interest rates and often catalyzes volatility in risk assets. Despite the next change in interest rates being a month away, government and private-sector data predict a continued decline in inflation over the coming months.

Regarding the short-term BTC price action, Bitcoin bulls have been unsuccessful in recovering below $30,000 following the Binance “FUD” incident, leading to a market that appears overly saturated with shorts. This is supported by market makers selling into minor price upticks, as noted by monitoring resource Skew.

Meanwhile, Material Indicators observed an increase in bid liquidity just below the $26,000 mark on the Binance BTC/USD order book overnight, with accompanying chart comments suggesting that liquidity will move around the order book before the morning economic reports.

Sharp Decline in Inflation in the Next 2-3 Months?

Financial commentator Tedtalksmacro indicated in a recent YouTube analysis on May 9th that while some stagnation may be seen in the short term, inflation is expected to steadily and sharply decline in the next two to three months.

This prediction is supported by both the Cleveland Fed inflation forecast and “Trueflation,” an unofficial leading indicator of inflation trends.

Tedtalksmacro also shared a subsequent tweet on the same day, illustrating potential BTC price fluctuations relative to various possible CPI numbers and the corresponding probabilities according to JPMorgan Chase.

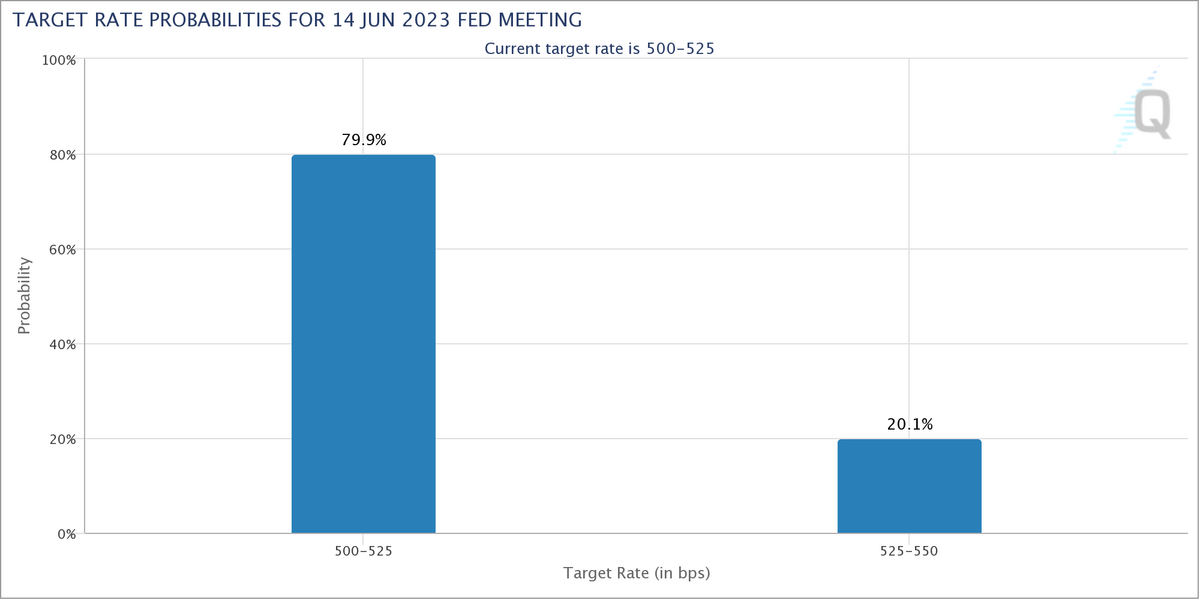

As per CME Group’s FedWatch Tool, the market is predicting an 80% chance of the Fed halting its interest rate hikes in June to tackle inflation.

Target Rate Possibilities for June 2023. Source: CME Group’s FedWatch Tool

Target Rate Possibilities for June 2023. Source: CME Group’s FedWatch Tool

On the Flipside

- While CPI is a significant metric for the Federal Reserve when determining interest rates, some experts argue that it is an incomplete measure of inflation, as it doesn’t consider other important factors, such as asset prices.

- Bitcoin’s correlation to CPI remains somewhat tenuous, as the digital asset has often been subject to various factors influencing its price, such as market sentiment, regulatory news, and technical analysis.

- As with any prediction or forecast, there is always the possibility of inaccuracy or unforeseen events that could impact the outcome.

Why You Should Care

The upcoming release of the April Consumer Price Index (CPI) is an important event for the crypto market, as it serves as a key metric for the Federal Reserve in determining changes to interest rates.

Source : [Understanding the Upcoming U.S. CPI Data Amid Bitcoin’s $27.5k Surge](dailycoin.com/understanding-upcoming-us-cpi-data-amid-bitcoin-surge/) by Kyle Calvert - DailyCoin by Kyle Calvert / May 10, 2023